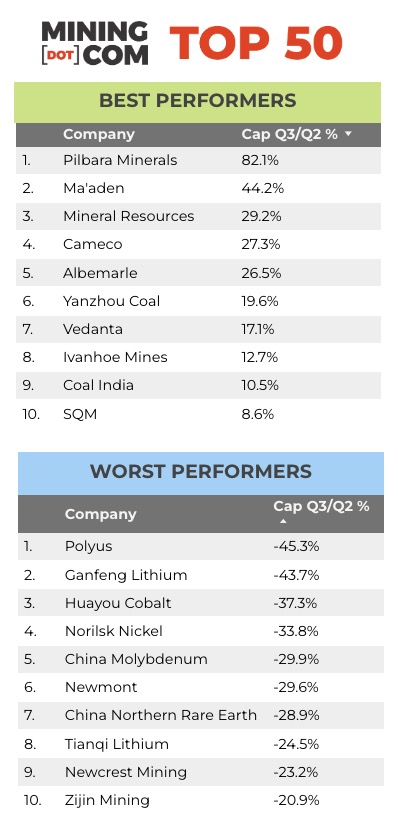

Volatility on metal and mining markets continued in the third quarter with copper losing sight of record prices hit in March, gold’s bounce back sputtering, lithium doubling in price year to date, coal surging to unprecedented levels, potash advancing to a 14-year peak and uranium experiencing the best market since Fukushima.

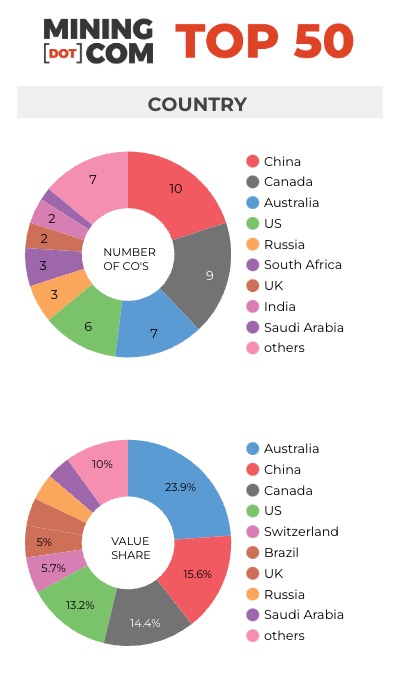

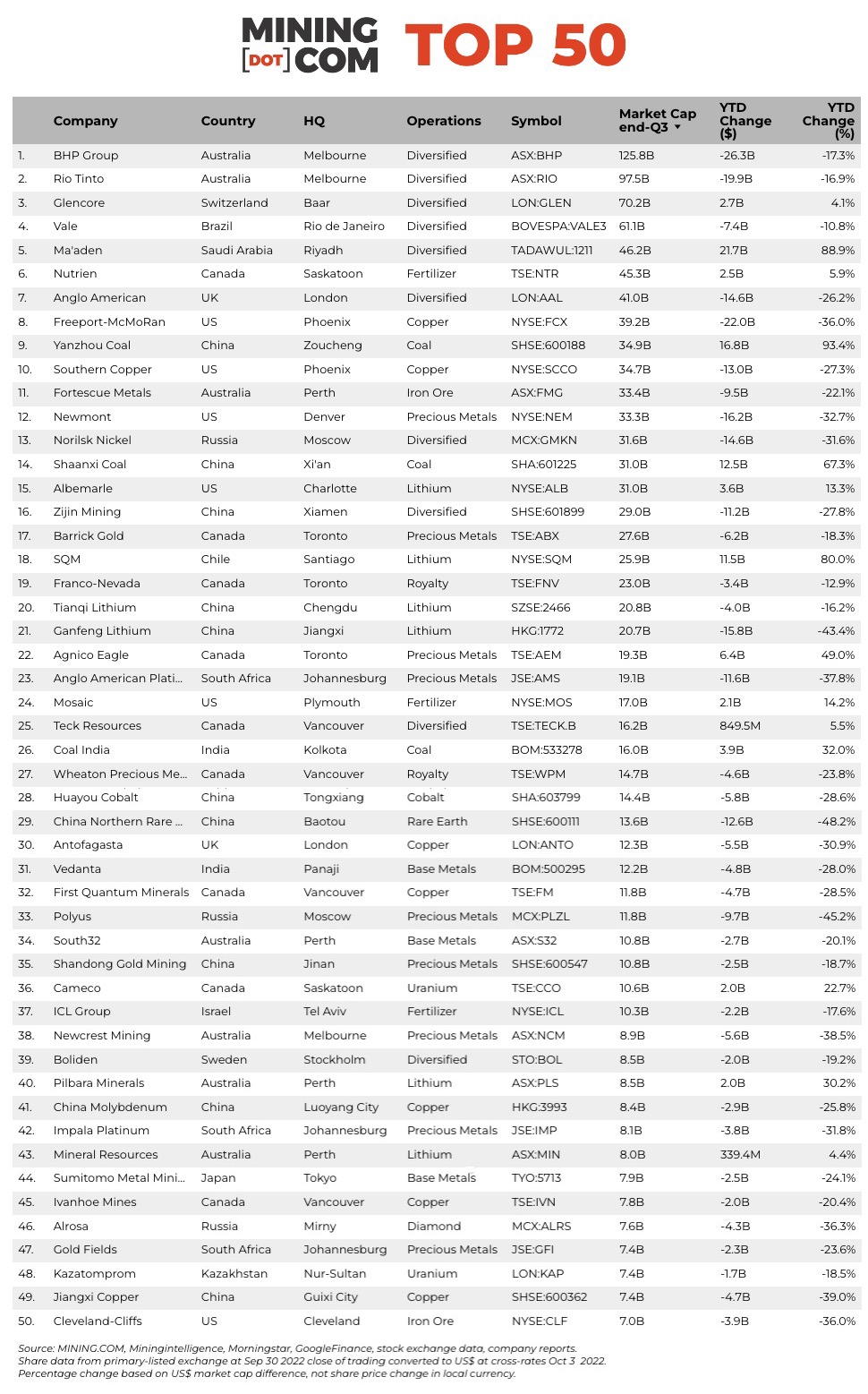

The MINING.COM TOP 50* ranking of the world’s most valuable miners lost $134 billion – based on primary exchange share price movements converted into US dollar – over the course of the third quarter and are now worth $1.22 trillion.

From its peak at the end of March the combined value of the top 50 has now shrunk by more than $500 billion with fertilizer, lithium and coal companies the only stocks showing gains in 2022.

Losses on the LSE, ASX and TSX were compounded by a soaring dollar against all major currencies with BHP, which flirted with a $200 billion in April to briefly become the most valuable stock on the FTSE, now worth $75 billion less.

Coal on fire

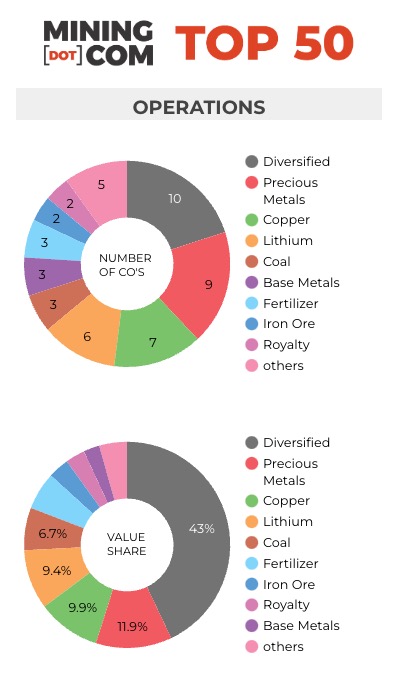

After spending time outside the top 10 last year, Glencore’s position at no. 3 at a valuation of $70 billion end-Q3 now seems secure. The Swiss giant is benefitting from a strategy not to ditch coal like its peers and a trading arm making the most of sky high prices for energy.

Among the heavyweights, pure play copper companies were hardest hit with average losses in market capitalization since the start of the year at 31%. Vancouver’s Teck Resources, thanks to its exposure to Canadian oil sands and coal is the lone base metal producer to show gains this year.

Coal companies are the best performers on the index with Shaanxi Coal up 67% and Yanzhou Coal nearly doubling in value this year in dollar terms despite a declining renminbi. Coal India, the world’s number one producer of steam coal, is also enjoying a bull market, up over 32% in 2022.

Nirvana lithium

A doubling of lithium prices so far this year in China and record prices for spodumene saw two new entrants in the top 50 from the sector, bringing the number of lithium companies in the top 60 to six.

While Chinese stocks suffered a terrible quarter, into the teeth of a falling Aussie dollar, Mineral Resources jumped 10 places to no. 43 during Q3 while Pilbara Minerals rocketed to no. 40 after rising 45% on the ASX.

Fellow Australian lithium players on their current trajectory could soon join the ranking – Allkem sits at no. 58 while IGO is bubbling under at no. 52, just below Kumba iron ore.

Chile’s only representative in the top 50 – SQM – is up more than 80% so far this year as the Santiago company reports an astonishing 10-fold jump in profits while top producer Albemarle has become a fixture in the top 20 at no. 15.

Russian retreat

While trading on Western markets in Russian stocks has been halted, the country’s miners, much like the rouble and the Moscow Stock Exchange, until recently defied gravity.

Norilsk Nickel, thanks to captive investors on the MCX, is still worth north of $30 billion, but that is down $16 billion during Q3. The PGM, nickel and copper producer had nominally been the fifth most valuable company at end-June, but now appears locked out of the top 10.

Diamond giant Alrosa has managed to stay in the ranking at no. 46 while a $10 billion decline in value sees Polyus drop 13 places at a valuation of $11.7 billion.

*NOTES:

Source: MINING.COM, Miningintelligence, Morningstar, GoogleFinance, company reports. Trading data from primary-listed exchange at September 30, 2022 where applicable, currency cross-rates October 3, 2022.

Percentage change based on US$ market cap difference, not share price change in local currency.

Market capitalization calculated at primary exchange from total shares outstanding, not only free-floating shares.

As with any ranking, criteria for inclusion are contentious issues. We decided to exclude unlisted and state-owned enterprises at the outset due to a lack of information. That, of course, excludes giants like Chile’s Codelco, Uzbekistan’s Navoi Mining, which owns the world’s largest gold mine, Eurochem, a major potash firm, Singapore-based trader Trafigura, and a number of entities in China and developing countries around the world.

Another central criterion was the depth of involvement in the industry before an enterprise can rightfully be called a mining company.

For instance, should smelter companies or commodity traders that own minority stakes in mining assets be included, especially if these investments have no operational component or warrant a seat on the board?

This is a common structure in Asia and excluding these types of companies removed well-known names like Japan’s Marubeni and Mitsui, Korea Zinc and Chile’s Copec.

Levels of operational or strategic involvement and size of shareholding was another central consideration. Do streaming and royalty companies that receive metals from mining operations without shareholding qualify or are they just specialised financing vehicles? We included Franco Nevada, Royal Gold and Wheaton Precious Metals.

Lithium and battery metals also pose a problem due to the booming market for electric vehicles and a trend towards vertical integration by battery manufacturers and mid-stream chemical companies. Battery producer and refiner Ganfeng Lithium, for example, is included because it has moved aggressively downstream through acquisitions and joint ventures.

Vertically integrated concerns like Alcoa and energy companies such as Shenhua Energy where power, ports and railways make up a large portion of revenues pose a problem as do diversified companies such as Anglo American with separately listed majority-owned subsidiaries. We’ve included Angloplat in the ranking as well as Kumba Iron Ore.

Many steelmakers own and often operate iron ore and other metal mines, but in the interest of balance and diversity we excluded the steel industry, and with that many companies that have substantial mining assets including giants like ArcelorMittal, Magnitogorsk, Ternium, Baosteel and many others.

Head office refers to operational headquarters wherever applicable, for example BHP and Rio Tinto are shown as Melbourne, Australia but Antofagasta is the exception that proves the rule. We consider the company’s HQ to be in London, where it has been listed since the late 1800s.