Market analyst Wood Mackenzie warns that the ongoing metals and mined commodity price spikes, combined with heightened geopolitical tensions, could result in long-lasting market changes.

In recent months, factors including the Russia-Ukraine conflict, stimulated economies, thriving post-pandemic demand, and ongoing covid constraints on logistics have put supply chains under immense stress, triggering multiple price records for metals and mined commodities.

WoodMac’s vice president, Robin Griffin, said in a press note the drastic divergence of price and production cost could not last indefinitely, even if there were an enduring stranding of Russian production.

“A look at notional margins miners enjoy suggests that the price rises are fragile at best. Margins are way above historical norms, and such a drastic divergence of price and production cost cannot last indefinitely,” said Griffin.

“The disruption to regional and product price relationships also points to price fragility. For example, Asian steel prices remaining flat while iron ore and metallurgical coal prices continue to soar is incongruous, given their influence on steel production costs,” said Griffin.

According to WoodMac, the conflict “will undoubtedly” leave an indelible mark on some commodity markets.

“A prolonged shift in some Russian trade from Europe to China and India, and a lack of western participation in the Russian metals and mining sector are near certainties. But even if we ignore for a moment the serious geopolitical impacts on trade, the price shocks themselves will also engender potentially long-lasting change,” said Griffin.

WoodMac flagged several potential outcomes explicitly stemming from the current commodity price spikes. These include buyers taking a more conservative, risk-averse approach which could entail a preference shift towards longer-term contracts with less spot trade.

Some buyers are also expected to seriously consider vertical integration into supply chains once the uncertainty subsides, while governments may move to increase regulation to manage volatility.

WoodMac also suggested that price spikes could result in capital expenditure uncertainty. While project incentive prices have been well and truly left behind in the current price spike, the analyst noted that producers and investors typically needed to believe that changes were structural before committing. “The extreme volatility may, in fact, have the reverse effect as investors delay decisions until clarity improves,” said WoodMac.

Meanwhile, an immediate shift to alternative fuels is possible, particularly thermal coal and pulverized coal injection. Accelerated penetration of alternative technologies is also possible in the power and steel sectors if high prices persist, including the early advent of low carbon technologies such as hydrogen-based direct reduction iron.

Battery chemistry competition may also increase as exorbitant prices for lithium-ion battery raw materials drive manufacturers toward alternative chemistries such as lithium-iron-phosphate.

“There are, of course, a range of risks to global consumption from high energy prices that could affect demand for metals and mined commodities,” said WoodMac.

Further, WoodMac noted that mine inflation was surging as high prices shifted the focus from cost control and the rise of input costs.

“This is true across all mined products, where higher labour, diesel and power costs are already taking a toll. Some participants are privately forecasting that cost inflation will hit record highs.”

Further, price indices are coming under pressure. The London Metal Exchange’s recent decision to suspend nickel trading, and nullify completed transactions, had sent shivers down the spines of exchange users.

WoodMac expects it would take time to rebuild trust, and traded volumes are unlikely to recover immediately. “All price indices in affected commodities will see increased scrutiny,” said WoodMac.

Nickel nuance

Meanwhile, Fitch Solutions Country Risk & Industry Research reports high-grade nickel consumers seek alternatives to Russian supplies as battery-making costs surge with nickel prices.

Russia is the leading provider of Class 1 nickel mining, while China is the most significant player for refining.

Fitch said in its new report automakers, battery manufacturers, and industrial consumers would likely forge new business partnerships to source alternatives to high-grade nickel, as Russian supply remained constrained on the back of the Ukraine war.

To this end, China-based Tsingshan Group and other companies actively developing the capacity to refine lower-grade nickels are set to benefit.

Fitch also flagged shifting importer preferences, self-sanctioning, and a desire to minimize sanctions risks were affecting purchases of Russian nickel exports.

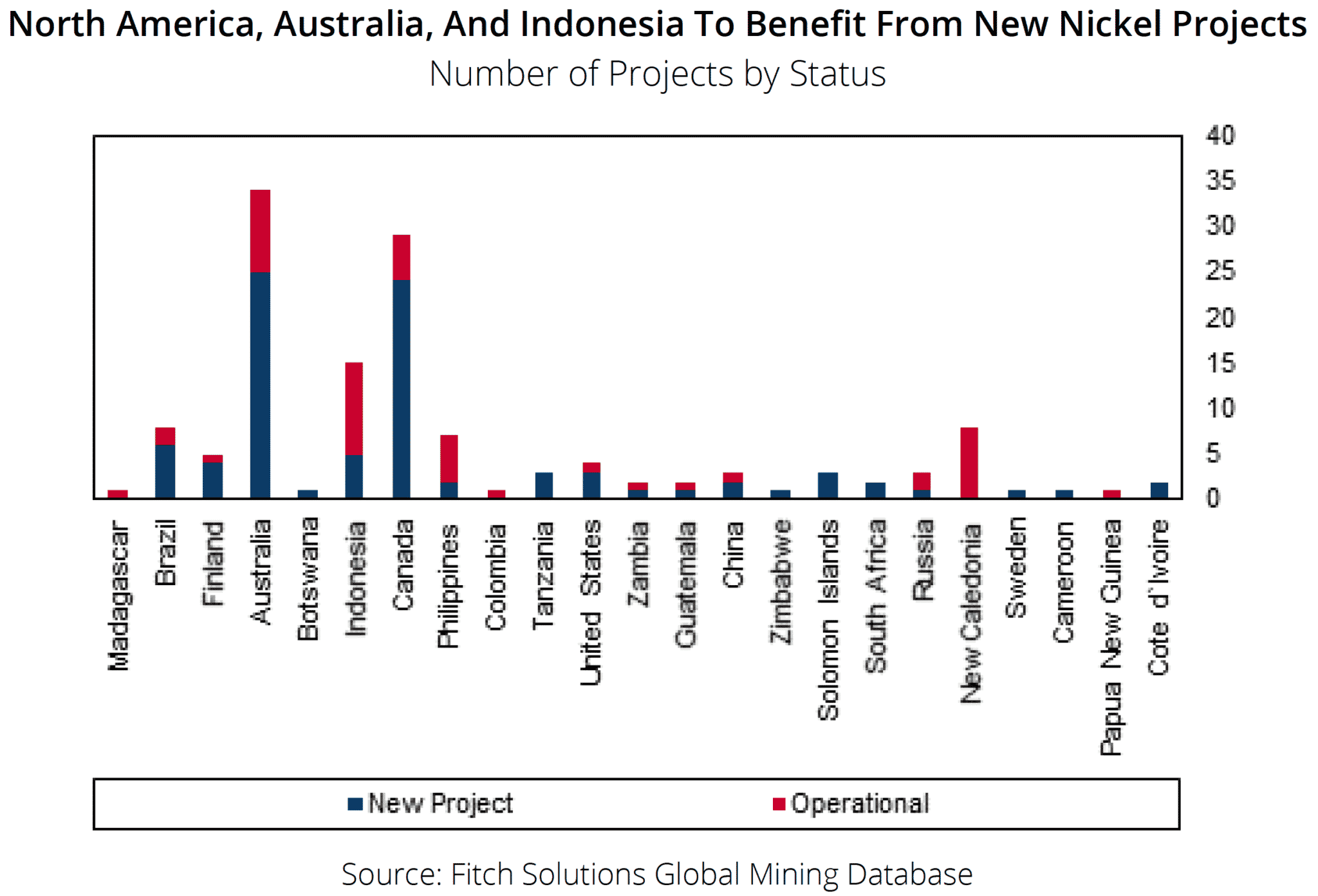

As a result, mining and refining operations in ‘safe’ countries with more stable regulatory and trade regimes were likely to benefit.

According to Fitch, Indonesia is likely to see increased interest in refining projects due to domestic policy and Tsingshan’s example but suffers from policy uncertainty. The changing preferences between higher and lower grades will also affect the medium to long-term market forecasts as the market settles and more deals are announced, said Fitch.

This story first appeared in Mining.com HERE