Cutting their own emissions is the most effective way for miners to respond to climate change, White & Case’s annual Mining & Metals Survey found.

According to the poll – which gathered information from 63 decision-makers in the mining and metals sector – 37% of mining companies in the sample believe that comitting to carbon neutrality is the way to go to stay in business. This is particularly the case considering that emissions from both their operations and those caused when the materials they mine are used by their customers remain significant obstacles for many investors.

This new reality led nearly every major miner to commit, back in 2021, to becoming carbon-neutral at their own operations over the next two to three decades and to develop roadmaps to achieve such a goal.

“Most striking was Rio Tinto’s pledge to spend $7.5 billion to halve its own emissions by the end of this decade,” White & Case’s report reads. “The scale of the investment to future-proof its business rather than drive immediate shareholder returns shows just how seriously the industry is taking it, but also the scale of the costs involved.”

In addition to cutting emissions, miners are placing increased focus and spending on energy transition materials, with 31% of respondents venturing into this realm, up from 6% last year. In fact, major firms are increasingly looking to take stakes in junior miners sitting on forward-facing commodities such as copper, nickel and lithium.

In the view of the experts at White & Case, this is particularly the case considering that big gold M&As have come to a halt and companies are repositioning their portfolios.

“There was a small window at the start of the pandemic when equity values plummeted, but now with many of the miners trading near record highs, transformational M&A looks to be an unlikely prospect,” the dossier reads. “According to our survey, that means opportunistic deals remain the most likely, especially as portfolios continue to shift toward more ESG-friendly commodities. Some 42% of respondents expect consolidation in the battery minerals space this year, up from only 13% a year ago.”

Among the battery metals gathering attention, copper is king as the biggest miners remain bullish on its prospects, with demand expected to surge this decade and new supplies looking increasingly scarce.

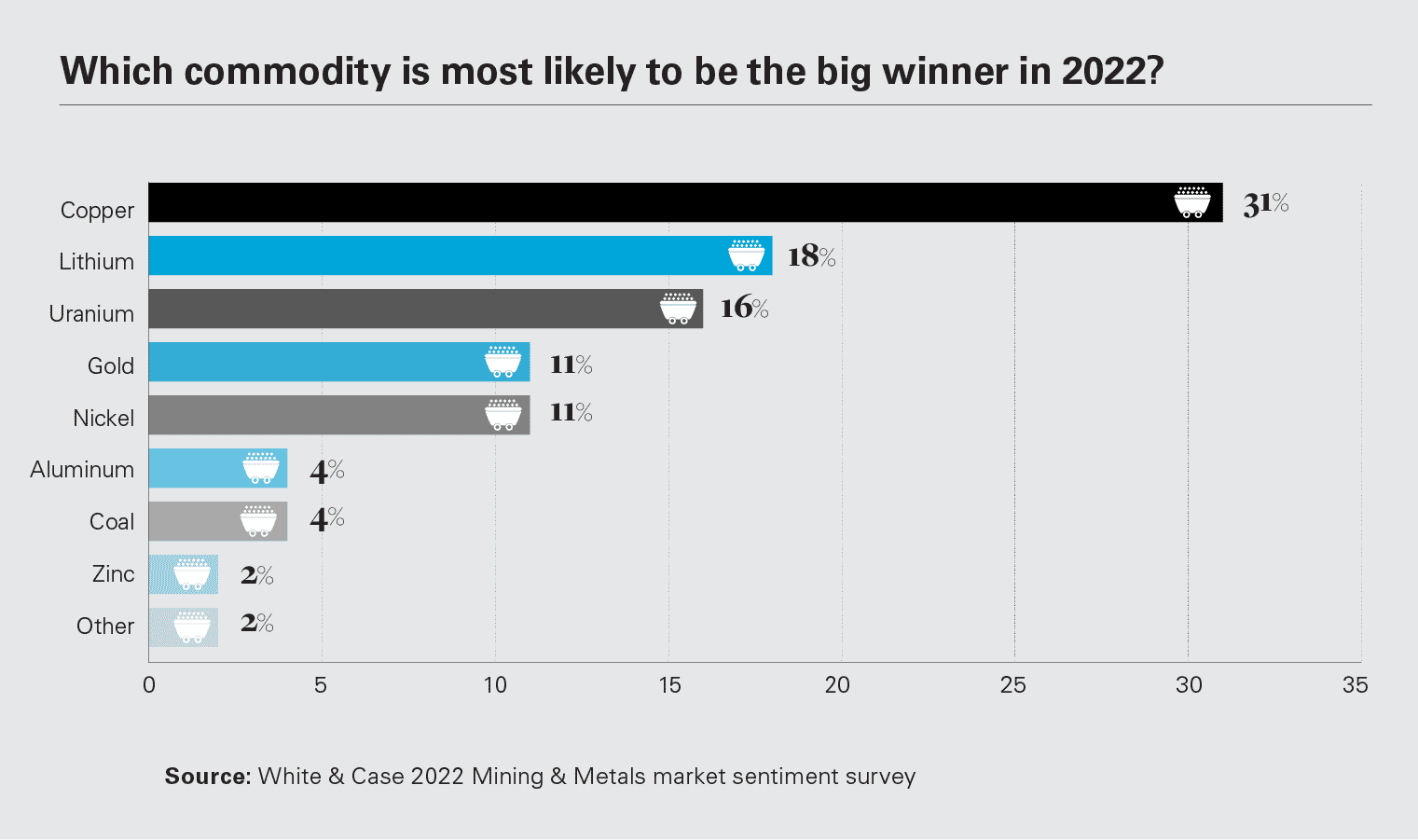

“For the third straight year, our survey has picked copper to be the best-performing metal in 2022, with 31% saying it’s set for another year of outperformance,” White & Case’s study reads. “The metal, an economic bellwether and key material for the energy transition, hit record prices last year, breaking above $10 thousand per ton. Minor production losses, from both covid-19 disruptions and water issues in Chile, combined with strong industrial demand. Our respondents’ enthusiasm for the metal is matched by the wider mining industry.”

In addition to copper, the second pick is lithium, the crucial ingredient for electric vehicle batteries.

Based on its survey and market analyses, W&C predicts market tightness is likely to persist in the near term supported by the mining industry’s inability to keep up with demand so far, despite efforts to expand lithium capacity.

Recycling

In addition to miners’ interest in battery metals and the energy transition, their green commitments have also pushed them to look into recycling both already-processed metals and tailings dumps on mine sites.

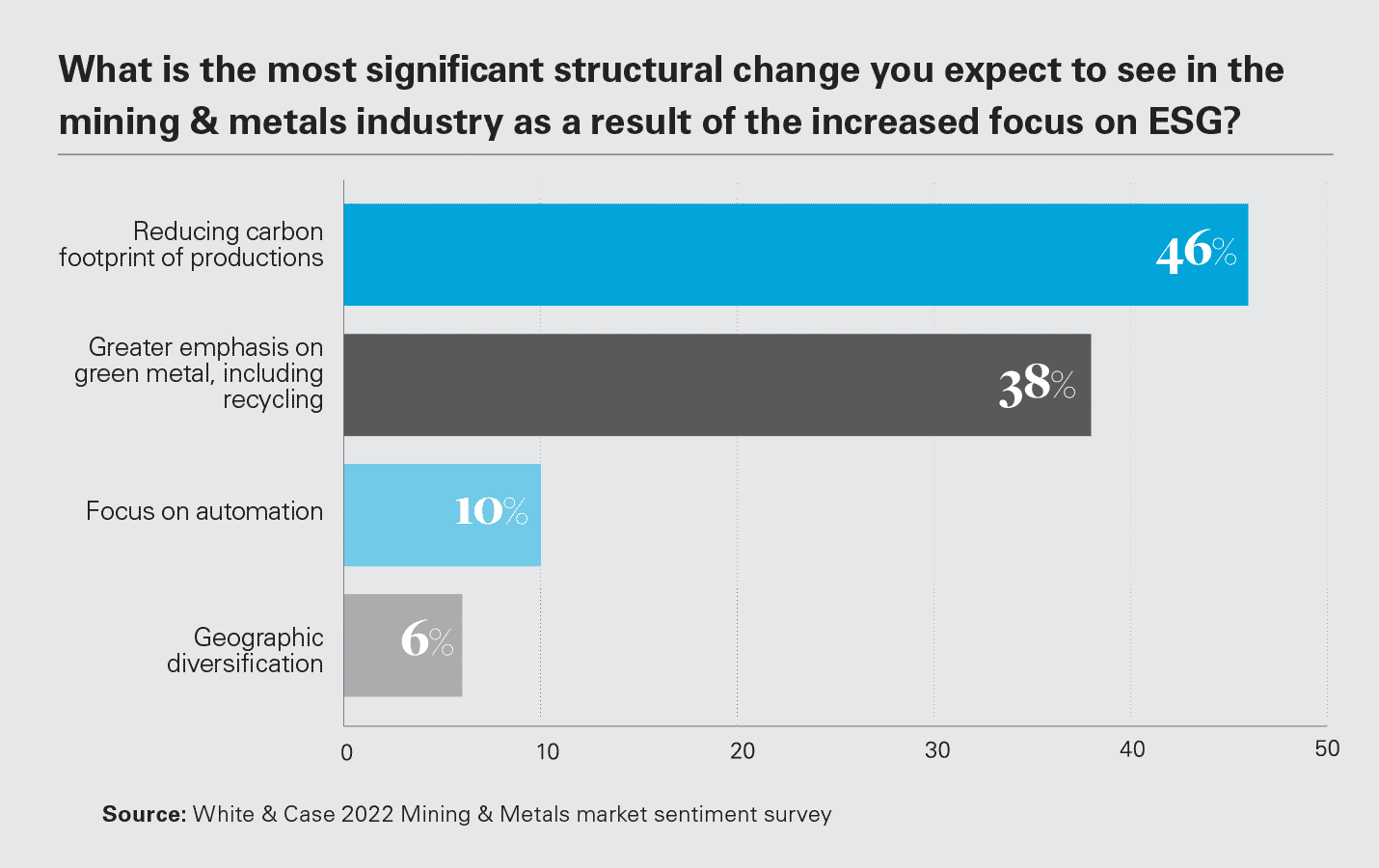

White & Case’s survey showed that 38% of respondents see increased recycling as a key structural shift that the industry can undertake to burnish its ESG credentials.

“Although early-stage, this has begun to play out with miners and downstream players seeking to build on the opportunity,” the document states. “Glencore has been steadily increasing its recycling capacity, especially for electronic waste, while BHP and Freeport have invested in Jetti Resources, a US startup that says it can process millions of tons of copper from existing waste dumps.”

For the law firm, it is likely that the trend towards recycling will accelerate further in the coming years as technologies improve, especially if commodity prices continue to rise.

This story first appeared on Mining.com HERE